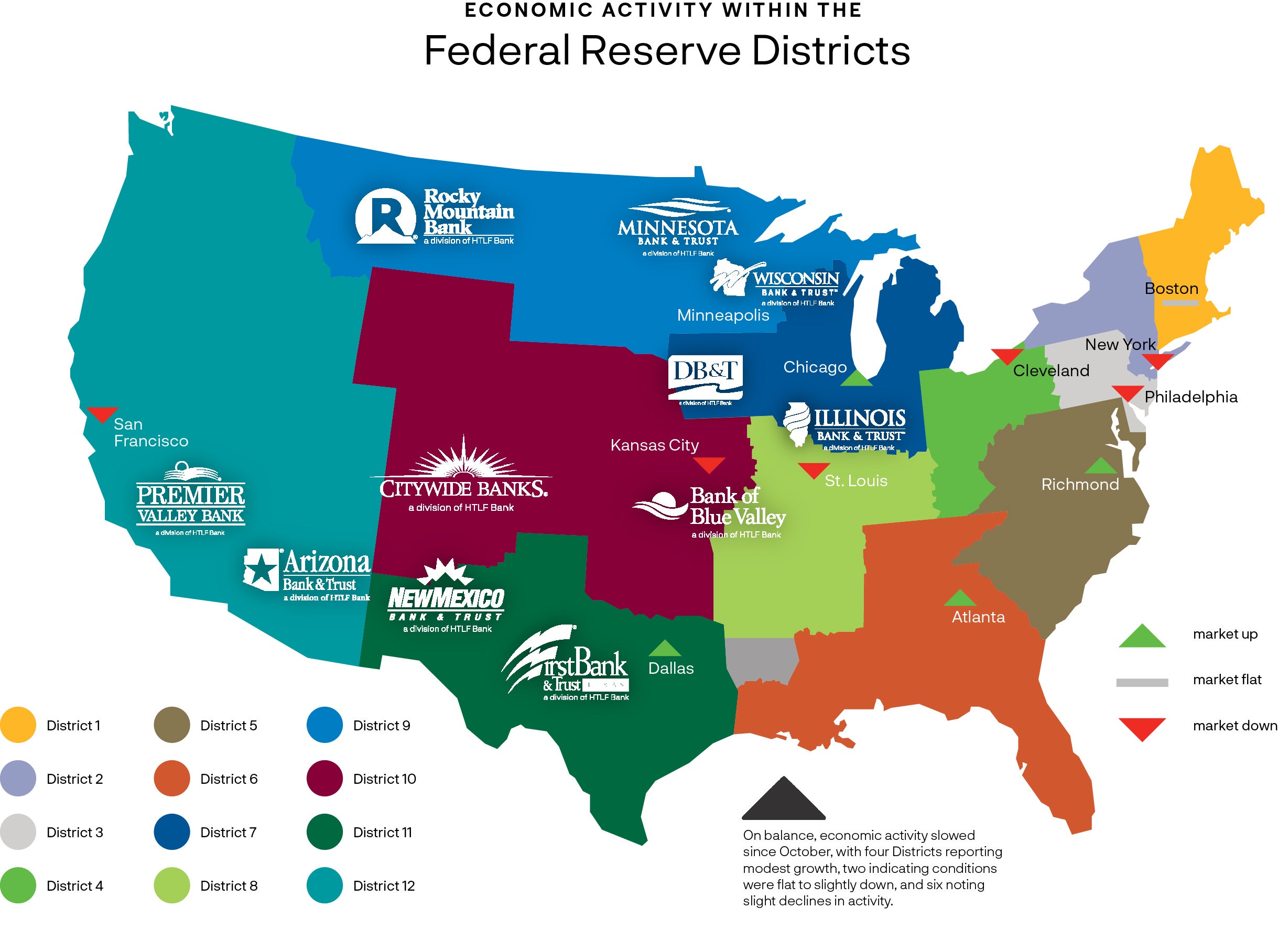

Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.

Overall Economic Activity

Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers’ outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Labor Markets

Demand for labor continued to ease, as most Districts reported flat to modest increases in overall employment. The majority of Districts reported that more applicants were available, and several noted that retention improved as well. Reductions in headcounts through layoffs or attrition were reported, and some employers felt comfortable letting go low performers. However, several Districts continued to describe labor markets as tight with skilled workers in short supply. Wage growth remained modest to moderate in most Districts, as many described easing in wage pressures and several reported declines in starting wages. Some wage pressures did persist, however, and there were some reports of continued difficulty attracting and retaining high performers and workers with specialized skills.

Prices

Price increases largely moderated across Districts, though prices remained elevated. Freight and shipping costs decreased for many, while the cost of various food products increased. Several noted that costs for construction inputs like steel and lumber had stabilized or even declined. Rising utilities and insurance costs were notable across Districts. Pricing power varied, with services providers finding it easier to pass through increases than manufacturers. Two Districts cited increased cost of debt as an impediment to business growth. Most Districts expect moderate price increases to continue into next year.

Outlook Across the 11th District

The Eleventh District economy expanded at slower pace than in the previous reporting period. Manufacturing output rose, while growth in services stalled out and retail sales fell. Loan volumes declined at a faster rate than the previous reporting period as credit conditions remained tight and the cost of credit high. Home sales decreased, and activity in the energy sector was flat to up. Recent rains somewhat improved district agricultural conditions. Local nonprofits continued to cite broad based increases in demand for assistance. Employment was little changed, and wage growth continued to normalize. Input cost and selling price growth were above average in the service sector but modest to slight in manufacturing, construction, and energy. Outlooks remained negative with geopolitical instability, heightened macroeconomic uncertainty, and the high cost of credit cited as key headwinds.

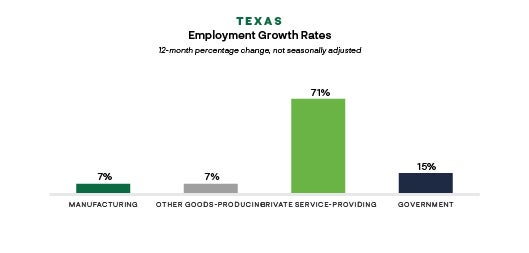

Labor Markets

Employment expanded slightly over the past six weeks. The pace of hiring decelerated broadly, and some freight carriers, high-tech, and manufacturing companies reported layoffs. A few service firms said they were keeping staff on payrolls despite a notable drop in sales, though one respondent said they plan to cut salaries in early 2024 to avoid layoffs. Labor availability improved and reports of labor shortages were less prevalent. One staffing firm said they were more comfortable letting unproductive workers go since they felt more confident about replacing them. However, shortages of engineers, restaurant workers, and specialty construction labor persisted.

Wage growth continued to normalize, though it was still slightly elevated. Homebuilders noted some reprieve in labor costs, and energy companies said wage growth was slowing with pressures limited to select job categories. However, a fabricated metal manufacturer reported paying workers for 40 hours/week though the firm did not have enough work to keep them busy. Most staffing firms saw continued upward wage pressures, though one contact anticipates some easing in the first half of 2024 as hiring is expected to slow.

Prices

Input cost and selling price growth was mixed, still slightly elevated in the service sector but generally modest in construction, manufacturing, and energy. Growth in airfares eased amid increased capacity, and fuel costs ticked up. Construction materials, home, and land prices were mostly unchanged but elevated. Freight shipping rates fell, and a transportation firm reported that companies were signing longer-term freight contracts due to low rates. Numerous firms cited higher borrowing costs as an impediment to business growth.

Retail sales

Retail sales declined during the reporting period. Some retailers attributed the weakness in spending to elevated economic uncertainty and high interest rates. Reduced affordability resulting from higher car prices and interest rates also depressed auto sales over the past six weeks. Overall, retail inventories dipped for the first time since mid-2022, and outlooks remained negative.

Manufacturing

Texas manufacturing activity expanded modestly in October. In durables, production increases were led by fabricated metals and machinery manufacturing. However, output in transportation equipment manufacturing declined, and a contact noted that the UAW strike somewhat hurt sales. Output rose in nondurable manufacturing. Chemical production was mixed, and refinery activity decreased. Overall, manufacturing outlooks worsened, and uncertainty remained elevated with several contacts citing geopolitical instability and high interest rates as headwinds.

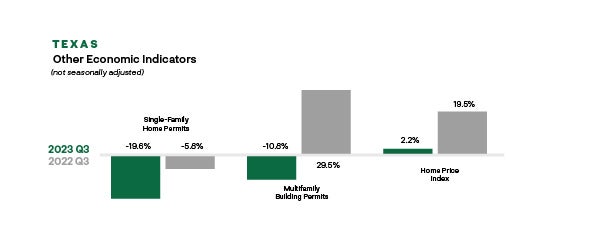

Real Estate and Construction

Housing demand weakened during the reporting period. Home sales and buyer traffic fell while cancellations rose, and contacts pointed to higher mortgage rates as the key factor impacting activity. Buyer incentives including rate buydowns and discounting remained widespread, and there were reports of additional incentives being offered to discourage buyers from cancelling contracts. Outlooks were weak and contacts noted reduced affordability, high mortgage rates, and tighter lending for construction and development loans as headwinds.

Activity in commercial real estate softened. Apartment leasing slowed and rents were flat to down. Office leasing remained minimal; vacancy rates were high, and concessions remained generous. With new supply outpacing demand, industrial vacancy rates ticked up and rent growth cooled. Heightened macroeconomic uncertainty, high capital costs, and diminished appetite to lend continued to deter investment across property types.

Energy

Oil field activity was flat to up over the past six weeks. The recent spate of mergers and acquisitions continued to put slight downward pressure on activity levels. Orders for oilfield services equipment were stable as customers limited spending to maintaining current capacity. In 2024, capital expenditure growth in oil and gas production is anticipated to be concentrated in international offshore drilling, with only modest increases expected in U.S. production-related work.

Agriculture

Recent rainfall improved soil moisture over the past six weeks, though much of the District remained in drought. Crop production was substantially higher this year across the board—wheat, cotton, corn, sorghum, and soybeans—largely due to drought conditions being less severe than last year, particularly in the Texas panhandle. Cattle prices declined over the reporting period but remained elevated, and contacts noted a continued tight supply of cattle and resilient demand for beef amid high prices.

Nonfinancial Services

Service sector activity held steady during the reporting period. Overall, revenues were flat on net, with numerous firms pointing to heightened macroeconomic and geopolitical uncertainty and high interest rates as factors impacting demand. Revenues were flat to down in several industries, including transportation and warehousing and professional and business services but rose in healthcare. Leisure and hospitality firms said revenues continued to soften partly due to slower consumer spending and high economic uncertainty, and one contact said their expansion plans were on hold until year end 2024. Staffing firms cited a slowdown in demand for their services, as demand for high-skilled workers weakened while placements for support staff and low-skilled workers remained stable. Airlines saw strong activity. Domestic leisure travel activity cooled, but international leisure travel stayed strong. Business travel was stable but trailed pre-pandemic levels.

Get Your Financial Feed Today

The Financial Feed is the premiere publication for banking insights. Each issue prioritizes strategies on how business leaders can continue to grow despite possible economic headwinds. We hope these findings help you conquer potential challenges and capitalize on opportunities.

Source: The Federal Reserve’s Beige Book

These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by HTLF of any of the products, services or opinions of the corporation or organization or individual. HTLF bears no responsibility for the accuracy, legality or content of the external site or for that of the subsequent links. Contact the external site for answers to questions regarding its content and privacy rules.